One of my favorite cash back cards out there today is the Barclaycard Arrival Card from Barclays Bank. Barclays has been getting more aggressive recently with some of the card offerings which is good for us because it means additional card products that we can use to diversify our point earning and redemptions.

Barclays released this card to go head-to-head with many of the fixed value point earning card, many of which come from Capital One and Bank of America.

How the Barclaycard Arrival Credit Card Works

The Barclaycard Arrival cars is a cash back card meaning that the points that you earn have a fixed value and can be redeemed for a fixed dollar amount.

What is unique (and somewhat a drawback) about the Barclaycard arrival card is that the points earned can only be redeemed for travel expenses – flights, hotels, rental cars plus many other categories as long as they are categorized as travel.

The annual fee of $89 is waived for the first year.

On the flip side earning points through the card is easier than some of the others – you earn 2 points for every dollar spent on the card. Each point is worth $0.01 that can redeemed for travel giving you a 2% rebate on all purchases which is a nice bonus.

Point redemptions come in the form of a statement rebate after the purchase has taken place on the card. That’s an important detail – in order to redeem Arrival Points the travel purchase must be made on the card.

After the purchase you can log onto your card account to redeem points and get the statement credit for the cost of the travel item.

Another feature of the card is a 10% rebate on all points redeemed for travel expenses. This means that if you have a $200 flight, you could redeem 20,000 points to pay for that flight. After you make that redemption your account will then be credited back with 2000 points which is worth $20, making your effective cost of the flight only $180.

One thing not to forget when doing your calculations is that you earn 200 points for purchasing that flight on the card.

Here is how the math works out:

- Purchase a $200 flight, which earns 400 points (worth $4). You will not have 20,400 points in your account.

- Redeem 20,000 points for your flight, which will take your flight cost down to $0.

- Get 2000 points back from the 10% rebate (worth $20).

Now you’ll be left with 2400 points in your account, which is worth $24 towards travel! Just by purchasing that flight you come out ahead by $24 – not a bad deal at all.

The current sign up bonus is 40,000 points after you spend $3,000 within the first three months of opening the account. After the spend requirement you will have a minimum of 43,000 points in your account which can be redeemed for $482 worth of travel!

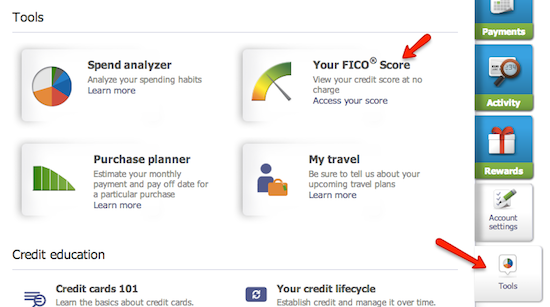

One additional benefit of the card which I really like is the free FICO score that it provides you with. Click on tools in the sidebar then FICO score on the next menu. You’ll have access to check your FICO score as often as you would like, all for free!

How to Redeem Your Points

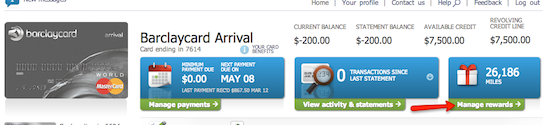

Redeeming points is very simple with the Barclaycard Arrival. Login to your account on Barclaycard.com and select the Arrival card. On the right hand side you will see your points total that you have available to redeem.

Underneath your points total you will see a link that says redeem points for travel.Click on that link and you’ll be taken to a screen that will allow you to redeem your points.

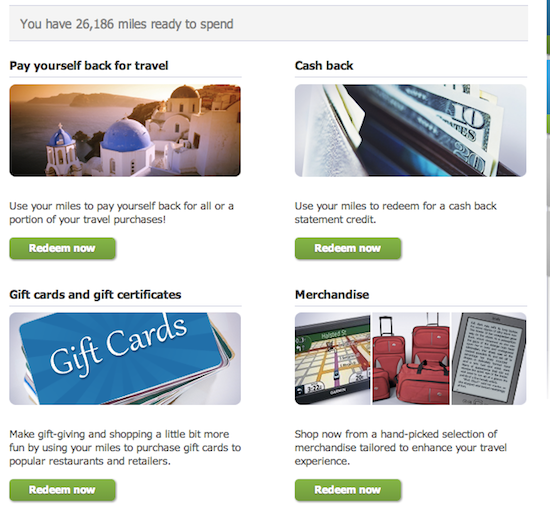

You’ll see four options that you have to redeem you points – I highly recommend against using your points for anything other than travel redemptions.

For example if you redeem for straight cash back your points are worth a measly $0.005, half the value of if you were to redeem for travel.

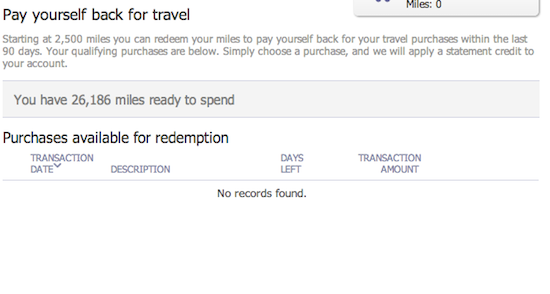

On this screen you will see all of the travel related expenses that you have charged to your card that are eligible to be redeemed points for. I don’t have any recent charges to show you but if you do have travel charges they will appear there.

Simply select the travel expense from the list and set the number of points that you would like to use for that expense.

You can select the full amount to be redeemed or partial amounts if you have not enough points to cover a full amount. You have 90 days from when the card was changed to be able to redeem through the website, after the 90 days the expenses become ineligible for redemption. The minimum point redemption is 2,500 points ($25).

If you redeem expenses with points after you have already paid that month’s statement in full you will receive a credit for that redemption on your next statement. As you can see from my screenshots I have a -$200 balance on my card currently, I just redeemed points for taxes/fees on two award tickets.

I would rate this card well above the Disney Visa in terms of credit cards for a few reasons:

- The Disney Visa (sometimes) has a $200 rebate offer towards Disney expensed whereas the Barclaycard Arrival Card will get you $430 worth of travel including Disney.

- The Disney Visa earns 2x points only a certain locations (supermarkets, gas stations) where the Barclaycard Arrival card earns 2x points on every purchase.

- One perk of the Disney Visa are some of the discounts at the parks included but the sign up bonus and earning power of the Barclaycard Arrival card far outweigh those discounts.

Uses for Disney Vacations

I recommend using your Barclaycard Arrival points for expenses on your Disney vacation that are difficult to get cheaply or with discounts.

Resort Rooms

The current summer offer at Disney Value resorts puts a standard room cost at about $82/night including taxes & fees. With the Barclaycard Arrival card sign up bonus alone you could redeem 41,000 points which would cover 5 nights at a value resort.

By putting that expense on your Barclaycard Arrival card you will earn 820 (worth $8.20) points and an additional 4100 points (worth $41) with the 10% rebate.

Not only would you have your room completely paid for but you would still come out ahead with 4920 points which is worth $49.20!

The possibilities are endless that you could spend $482 on at Walt Disney World on your vacation – here are a few ideas that you could spend the Barclaycard Arrival points on:

- Flights to Orlando

- Resort room

- Park tickets

- Park food

- Rental cars

- Any other travel fees or related expenses.

Conclusion

After showing the power of the Barclaycard Arrival points you can see why this is one of my favorites in the travel cards category.

Even though you are limited to redeeming points for travel, as long as you get this card around one of your Disney vacations you can automatically save up to $482+ on your next Disney vacation by just having this card!

Thank you so much for this article! We chose the Barclaycard last year with plans to use points for a Disney trip this year. We’ve been trying to figure out how redeeming our points for Disney would work exactly, and Disney has been giving us a huge run-around trying to say that the Disney Visa Rewards card is the only card that allows point redemption at Disney. 🙁 Thanks again!

Thanks Megan! To redeem your points with the Barclay Arrival card you will first need to put the charges such as your flights to Orlando or your hotel/resort rooms.

After those charges appear on your statement you can login to the site to redeem points, you’ll be credited that dollar amount on your next statement. I like these points over the Disney Visa points because Barclay points allow much more flexibility with redemptions.

You could also book your park tickets through a site like Travelocity, like I did. It will come up in the system as a regular travel expense and you’ll be able to redeem your points toward the cost.

I actually sweetened the deal by using Travelocity’s Best Price Guarantee. I found a website that was offering the tickets for cheaper that met their requirements (not hard, I actually found 2). I submitted the information, and in 48 hrs, I had a refund for the difference AND a $50 travel voucher for future travel with the site.

Thanks for the awesome tip Cynthia! I’ve used Travelocity for other travel arrangements but haven’t used it for Disney yet. I’ve been able to redeem points by using Priceline.com, next time I’ll give Travelocity a try and use my points for it.

Very helpful and easy to understand!

Question: I have 55,000 pts for my Barclay Arrival and my husband has 52,000 pts for his. I am going by myself on a trip and would like to use the points for an all-inclusive resort (hotel room/food/car/diving). The final hotel bill will be about $2100. ~Thx

Would my best option be to ask the hotel to charge half the bill on my card and half on his card?

Hi There! Yes your best bet would be to split the cost between the two cards – combined you’ll have $1070 towards the cost of your hotel which will be a really nice discount!

Can you actually redeem your points for WDW park food purchases? Has anyone actually been able to do this? I know you can if you charge the food to your hotel room. But if you don’t have a room, can you still redeem the points for park restaurants/food stands?

You can’t redeem points for actual food in the parks. You can redeem some point currencies for gift cards to restaurants like Olive Garden or Outback steakhouse for dining offsite.

so if I buy my park tickets at Disneyland website will Barclays code that purchase as travel? Anyone have experience in this?