Credit is one of your most important assets that you can have and is something that will follow you your whole life. Having bad credit will cost or save you a lot of money in the long run which is why you always want to make sure you’re doing the right things to keep your credit score high.

Credit is one of your most important assets that you can have and is something that will follow you your whole life. Having bad credit will cost or save you a lot of money in the long run which is why you always want to make sure you’re doing the right things to keep your credit score high.

Many of the strategies on Frugal Mouse revolve around having good credit which we use to apply for credit cards to get points which we will then redeem for free travel and hotels. Having bad credit won’t allow you to get in on these lucrative credit card deals, costing you money.

What is Credit?

Per Experian:

“Credit is borrowed money that you can use to purchase goods and services when you need them. You get credit from a credit grantor, whom you agree to pay back the amount you spent, plus applicable finance charges, at an agreed-upon time.”

You are judged by the three major credit reporting agencies – Transunion, Experian and Equifax – based off of your credit score or how well you have performed in the past at paying back credit extended to you.

If you purchased a car through financing and were late with payments or defaulted on a loan your credit score would obviously be low because you didn’t do a good job of paying back the credit extended to you. You also want to show a good mix of the types of credit that you have been extended – credit cards, auto loans, mortgages – the more different types the better.

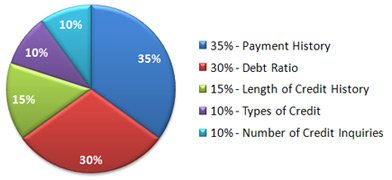

Your credit score is a combination of a few different types of measures:

- Payment history: The most important aspect of your credit score, how have you done with paying your bills?

- Credit History: The longer your credit history the better.

- Debt ratio: How much of your available credit are you actually using? You want to keep your debt ratio low to show that you’re not overextending the use of your credit.

- Credit Types: Showing different types of credit – auto loans, mortgages, credit cards – will give you a better score.

- Number of inquiries: How many times you’ve applied for credit. The lower the number the better.

A note about the number of inquires: we will be opening credit cards which will increase the number of inquiries, lowering your credit score a bit with each application. Yes this will temporarily lower your score but having additional credit will also improve your debt ratio so eventually you’ll get back that slight drop of 3-5 points.

If you’re always on time with your bills and have shown a good history of paying back credit your score will be high so people will want to extend credit to you (which is a good thing!).

Credit Check

First step is to see where your credit score is at today. You should always be checking up on your credit to make sure there are no mistakes on your report which unfortunately happens too much. There are a few ways to check your credit:

- You can get your credit score for free from Credit Karma

- MyFico is a commonly used credit score as well but you have to pay a small fee to see it.

- A govement mandate allows you to see your full credit report (but no scores) from all three credit bureaus once a year. You can get that report yearly from http://www.annualcreditreport.com

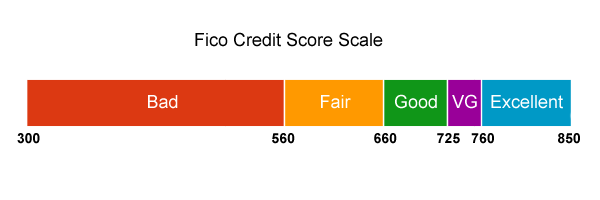

What we’re looking for is a credit score of 700 or greater which means that you have “good” credit. A score above 700 will allow you to be approved for pretty much all credit cards out on the market today.

If you’re under 700 you will need to work to get your credit score up above 700 before applying for credit cards. First you’ll want to identify why your credit score is low then look for ways to improve it. I won’t get into too much how to improve your score but just Google “improve credit score” and you’ll find plenty of resources.

Bottom Line

Your credit is one of your most important assets so you want to make sure you’re taking care of it. Having good credit will allow you to unlock the wonderful world of points which will help us get hotels, flights and many other things for free.